On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued

$100,000, 11%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $96,895 to yield

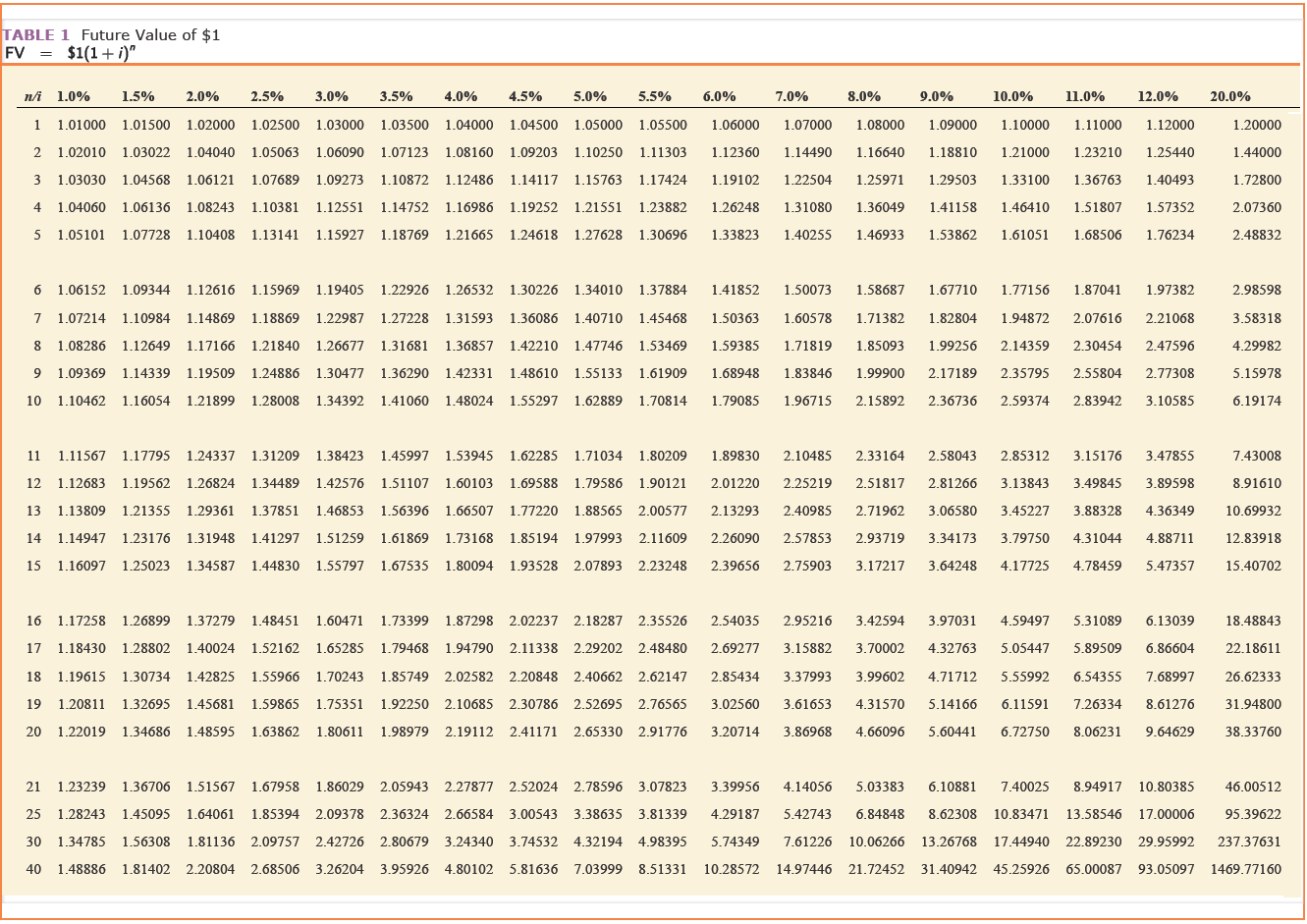

an annual return of 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule by the

straight-line method.

3. Prepare the journal entries to record interest

expense on June 30, 2020, by each of the two approaches.

5. Assuming the market rate is still 12%, what

price would a second investor pay the first investor on June 30,

2020, for $12,000 of the bonds?

Homework Answers

Answer 1.

Face Value of Bonds = $100,000

Issue Value of Bonds = $96,895

Discount on Bonds = Face Value of Bonds - Issue Value of

Bonds

Discount on Bonds = $100,000 - $96,895

Discount on Bonds = $3,105

Annual Coupon Rate = 11%

Semiannual Coupon Rate = 5.50%

Semiannual Coupon = 5.50% * $100,000

Semiannual Coupon = $5,500

Time to Maturity = 4 years

Semiannual Period = 8

Semiannual Amortization of Discount = Discount on Bonds /

Semiannual Period

Semiannual Amortization of Discount = $3,105 / 8

Semiannual Amortization of Discount = $388

Semiannual Interest Expense = Semiannual Coupon + Semiannual

Amortization of Discount

Semiannual Interest Expense = $5,500 + $388

Semiannual Interest Expense = $5,888

Answer 2.

Annual Interest Rate = 12%

Semiannual Interest Rate = 6%

Answer 3.

Answer 4.

June 30, 2020:

Market Value of $100,000 Bonds = $98,663

Market Value of $1,000 Bonds = $986.63 ($98,663 / 100)

Market Value of $12,000 Bonds = $11,840 ($986.63 * 12)

Add Answer to:

On January 1, 2018, Bradley Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 12%, four-year bonds. Interest is paid semiannually...

On January 1, 2018, Bradley Recreational Products issued $100,000, 12%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $94,029 to yield an annual return of 14%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $120,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $120,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $116,122 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $120,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million,...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

ACC 422T

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

On January 1, 2021, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $193,537 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Prepare an amortization schedule that determines interest at the effective interest rate.2. Prepare an amortization schedule by the straight-line method.3. Prepare the journal entries to record interest expense on...

2 Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

Most questions answered within 3 hours.

-

) Assume that in the market for widgets, demand is highly

elastic compared to supply. If...

asked 1 minute ago -

Why is a personal interview the most important step in the sales

selection process? What are...

asked 11 minutes ago -

In Python rOverlap (x1, y1, w1, h1, x2, y2, w2, h2) A rectangle

is axis-aligned if...

asked 11 minutes ago -

If we observe in a protein solution that DNA is causing a

mixture 260/280 ratio ~0.9,...

asked 21 minutes ago -

Explain the steps involved in making cDNA from mRNA, and how you

would create a cDNA...

asked 22 minutes ago -

A beta (β) particle is described by which of the following?

Select the correct answer below:...

asked 24 minutes ago -

A new machine costs $150,000, lasts 10 years, has an annual

O&M cost of $50,000, and...

asked 28 minutes ago -

A newspaper in a large Midwestern city reported that the

National Association of Realtors said that...

asked 29 minutes ago -

1. Develop a use case diagram for the bank case study described

in Chapter 1. 2....

asked 39 minutes ago -

The phylum Protista has often been referred to as a junk drawer

of classification. Explain what...

asked 46 minutes ago -

The average amount of money spent for lunch per person in the

college cafeteria is $7.09...

asked 48 minutes ago -

You follow the lab procedure and at the end of Part 4C, you used

an average...

asked 1 hour ago

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued

$120,000, 8%, four-year bonds. Interest is paid semiannually on

June 30 and December 31. The bonds were issued at $112,244 to yield

an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1,

FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

Required:

1. Prepare an amortization schedule that determines

interest at the effective interest rate.

2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Bradley Recreational Products issued $140,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $130,952 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule...

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $60 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

2

Check my won On January 1, 2021, Bradley Recreational Products issued $150,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $145,153 to yield an annual return of 10%, (FY of $1. PV of S. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2....

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $850,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...

National Orthopedics Co. issued 8% bonds, dated January 1, with a face amount of $600,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the...