Homework Answers

Solution 1:

Value of tractor = Down payment + Present value of non interest bearing note

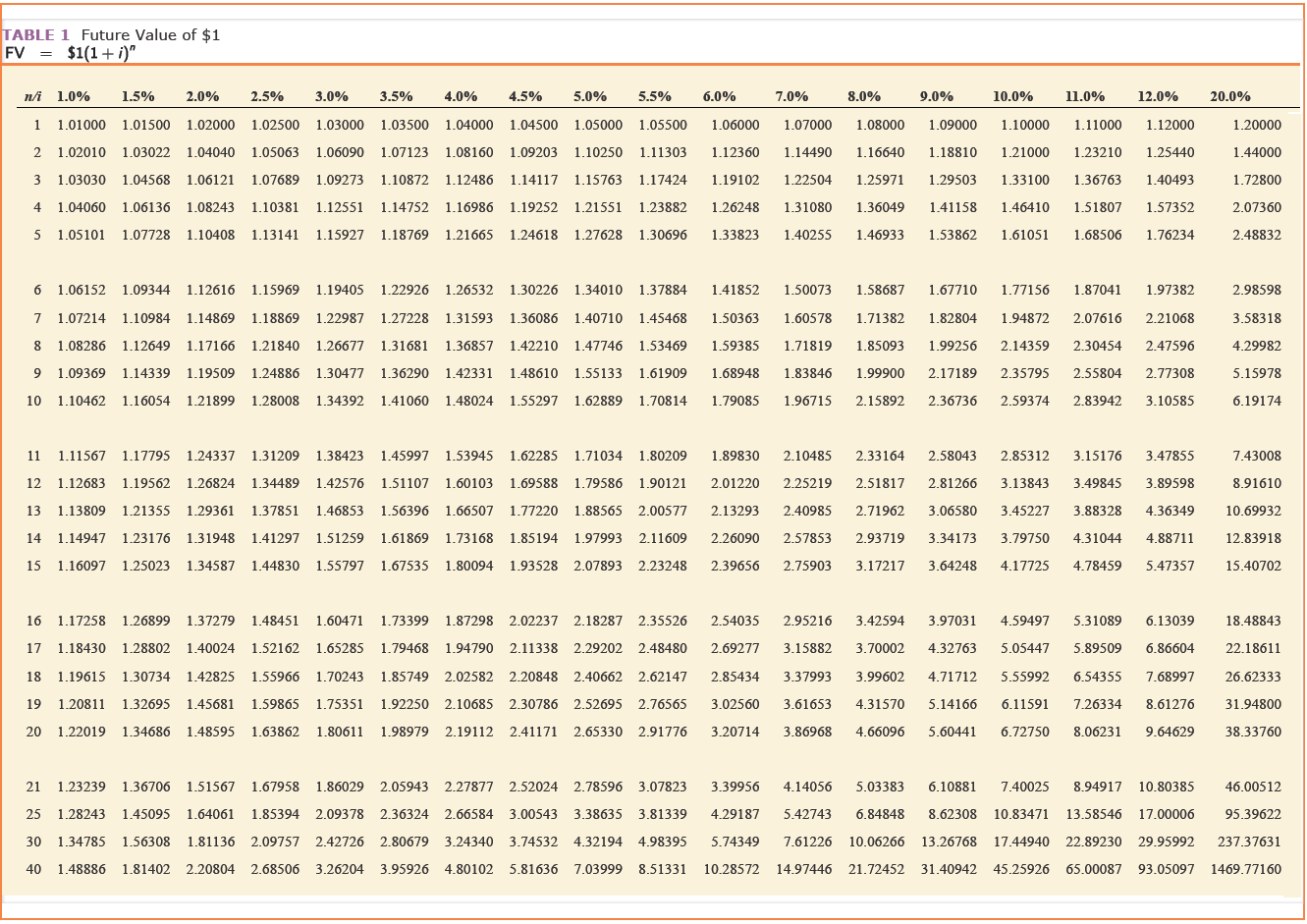

= $2,000 + ($29,000 * PV factor at 10% for 3rd period)

= $2,000 + $29,000*0.75132

= $23,788

| Journal Entry - Byner Company | |||

| Date | Particulars | Debit | Credit |

| 1-Jan-18 | Tractor Dr | $23,788.00 | |

| To Cash | $2,000.00 | ||

| To Notes Payable | $21,788.00 | ||

| (To record purchase of tractor) | |||

Solution 2 & 3:

Interest expense to be reported in 2018 income statement = $21,788*10% = $2,179

Liability amount to be reported in 2018 balance sheet = $21,788 + $2,179 = $23,967

Interest expense to be reported in 2019 income statement = $23,967*10% = $2,397

Liability amount to be reported in 2019 balance sheet = $23,967 + $2,397 = $26,364

Add Answer to:

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000...

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed...

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2018, Byner Company purchased a used tractor. Byner paid $4,000 down and signed...

On January 1, 2018, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $28,000 to be paid on December 31, 2020. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Check my work On January 1, 2018. Loop Raceway issued 640 bonds, each with a face...

Check my work On January 1, 2018. Loop Raceway issued 640 bonds, each with a face value of $1000, a stated interest rate of 6 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7 percent, so the total proceeds from the bond issue were $623.205. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year....

Check my work On January 1, 2018. Loop Raceway issued 640 bonds, each with a face value of $1000, a stated interest rate of 6 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7 percent, so the total proceeds from the bond issue were $623.205. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year....

SUBM 4 Check my work Tanner-UNF Corporation acquired as a long-term investment $190 million of 8.0...

SUBM 4 Check my work Tanner-UNF Corporation acquired as a long-term investment $190 million of 8.0 % bonds, dated July 1, on July 1, 2018. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 10 % for bonds of similar risk and maturity. Tanner-UNF paid $160.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions,...

SUBM 4 Check my work Tanner-UNF Corporation acquired as a long-term investment $190 million of 8.0 % bonds, dated July 1, on July 1, 2018. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 10 % for bonds of similar risk and maturity. Tanner-UNF paid $160.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions,...

points eBook Hint References Check my work Check My Work button is now enabledItem 6 Item...

points eBook Hint References Check my work Check My Work button is now enabledItem 6 Item 6 0.5 points Exercise 14-11 Bonds; effective interest; adjusting entry [LO14-2] On February 1, 2018, Strauss-Lombardi issued 10% bonds, dated February 1, with a face amount of $930,000. The bonds sold for $855,382 and mature on January 31, 2038 (20 years). The market yield for bonds of similar risk and maturity was 11%. Interest is paid semiannually on July 31 and January 31. Strauss-Lombardi’s...

journal entries financial accounting Check my work Brokeback Towing Company is at the end of its...

journal entries financial accounting

Check my work Brokeback Towing Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company's records and related documents: a On July 1, 2018, a two-year insurance premium on equipment in the amount of $480 was paid and debted in to Prepaid Insurance on that date Coverage began on July 1 At the end of 2018. the unadjusted balance in the Supplies...

journal entries financial accounting

Check my work Brokeback Towing Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company's records and related documents: a On July 1, 2018, a two-year insurance premium on equipment in the amount of $480 was paid and debted in to Prepaid Insurance on that date Coverage began on July 1 At the end of 2018. the unadjusted balance in the Supplies...

Check my work On January 1, a company purchased 2%, 10-year corporate bonds for $58,553,901 as...

Check my work On January 1, a company purchased 2%, 10-year corporate bonds for $58,553,901 as an investment. The bonds have a face amount of $70 million and are priced to yield 4%. Interest is paid semiannually. Prepare a partial amortization table at the effective interest rate on June 30 and December 31, Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. Complete this question by entering your answers in...

Check my work On January 1, a company purchased 2%, 10-year corporate bonds for $58,553,901 as an investment. The bonds have a face amount of $70 million and are priced to yield 4%. Interest is paid semiannually. Prepare a partial amortization table at the effective interest rate on June 30 and December 31, Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. Complete this question by entering your answers in...

Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid...

Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,750,000 in 2021 for the mining site and spent an additional $750,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The company has provided the following three cash flow possibilities for the restoration costs:...

Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,750,000 in 2021 for the mining site and spent an additional $750,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The company has provided the following three cash flow possibilities for the restoration costs:...

Check my work 17 On September 30, 2018, Athens Software began developing a software program to...

Check my work 17 On September 30, 2018, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2019, and the program was available for release on April 30, 2019. Development costs were incurred as follows: 10 points September 30 through December 31, 2018 January 1 through February 28, 2019 March 1 through April 30, 2019 $2,310,000 910,000 510,000 00:5307 eBook Athens expects a useful life of five...

Check my work 17 On September 30, 2018, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2019, and the program was available for release on April 30, 2019. Development costs were incurred as follows: 10 points September 30 through December 31, 2018 January 1 through February 28, 2019 March 1 through April 30, 2019 $2,310,000 910,000 510,000 00:5307 eBook Athens expects a useful life of five...

Most questions answered within 3 hours.

-

Assume that adults have IQ scores that are normally distributed

with a mean of µ =105...

asked 7 minutes ago -

Self-Study Problem 12.3

Part a:

Linda filed her tax return 2 months late. The tax paid...

asked 9 minutes ago -

1. How many MOLECULES of

boron trichloride are present in

8.03 grams of this compound ?...

asked 21 minutes ago -

var gArr = [

{food: 'apple', type: 'fruit'},

{food: 'potato', type: 'vegetable'},

{food: 'banana', type: 'fruit'}...

asked 30 minutes ago -

How can the four-speed of all material particles be

the speed of light even though they...

asked 26 minutes ago -

A broadband service offered by telephone companies that uses

copper wires already installed in homes and...

asked 24 minutes ago -

Most penguin species are not sexually dimorphic, which means

they lack obvious outward body characteristics which...

asked 42 minutes ago -

The equation for a firm’s short-run total cost is STC = 10 + 5q

+ 0.1q^2....

asked 57 minutes ago -

How can a cell gain energy while folding proteins in

the periplasm?

asked 1 hour ago -

Let X~UNIF(0,1), and Y=-lnX. Then what is the density function

of Y where nonzero?

asked 1 hour ago -

For the following Motivational Theories, please pick ONE THEORY

to answer the following 2 questions. (10...

asked 1 hour ago -

What is the energy change when the temperature of 11.7 grams

of gaseous xenon is decreased...

asked 1 hour ago

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 10% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Check my work On January 1, 2018. Loop Raceway issued 640 bonds, each with a face value of $1000, a stated interest rate of 6 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7 percent, so the total proceeds from the bond issue were $623.205. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year....

Check my work On January 1, 2018. Loop Raceway issued 640 bonds, each with a face value of $1000, a stated interest rate of 6 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7 percent, so the total proceeds from the bond issue were $623.205. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year....

SUBM 4 Check my work Tanner-UNF Corporation acquired as a long-term investment $190 million of 8.0 % bonds, dated July 1, on July 1, 2018. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 10 % for bonds of similar risk and maturity. Tanner-UNF paid $160.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions,...

SUBM 4 Check my work Tanner-UNF Corporation acquired as a long-term investment $190 million of 8.0 % bonds, dated July 1, on July 1, 2018. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 10 % for bonds of similar risk and maturity. Tanner-UNF paid $160.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions,...

journal entries financial accounting

Check my work Brokeback Towing Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company's records and related documents: a On July 1, 2018, a two-year insurance premium on equipment in the amount of $480 was paid and debted in to Prepaid Insurance on that date Coverage began on July 1 At the end of 2018. the unadjusted balance in the Supplies...

journal entries financial accounting

Check my work Brokeback Towing Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company's records and related documents: a On July 1, 2018, a two-year insurance premium on equipment in the amount of $480 was paid and debted in to Prepaid Insurance on that date Coverage began on July 1 At the end of 2018. the unadjusted balance in the Supplies...

Check my work On January 1, a company purchased 2%, 10-year corporate bonds for $58,553,901 as an investment. The bonds have a face amount of $70 million and are priced to yield 4%. Interest is paid semiannually. Prepare a partial amortization table at the effective interest rate on June 30 and December 31, Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. Complete this question by entering your answers in...

Check my work On January 1, a company purchased 2%, 10-year corporate bonds for $58,553,901 as an investment. The bonds have a face amount of $70 million and are priced to yield 4%. Interest is paid semiannually. Prepare a partial amortization table at the effective interest rate on June 30 and December 31, Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. Complete this question by entering your answers in...

Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,750,000 in 2021 for the mining site and spent an additional $750,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The company has provided the following three cash flow possibilities for the restoration costs:...

Check my work Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,750,000 in 2021 for the mining site and spent an additional $750,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately four years, the company is required to restore the land to its original condition, including repaving of roads and replacing a greenbelt. The company has provided the following three cash flow possibilities for the restoration costs:...

Check my work 17 On September 30, 2018, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2019, and the program was available for release on April 30, 2019. Development costs were incurred as follows: 10 points September 30 through December 31, 2018 January 1 through February 28, 2019 March 1 through April 30, 2019 $2,310,000 910,000 510,000 00:5307 eBook Athens expects a useful life of five...

Check my work 17 On September 30, 2018, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2019, and the program was available for release on April 30, 2019. Development costs were incurred as follows: 10 points September 30 through December 31, 2018 January 1 through February 28, 2019 March 1 through April 30, 2019 $2,310,000 910,000 510,000 00:5307 eBook Athens expects a useful life of five...