Homework Answers

Requirement 1:

| Date | Account title and Explanation | Debit | Credit |

| Jan 1,2021 | Tractor | $23,788 | |

| Discount on bonds payable | $7,212 | ||

| Cash | $2,000 | ||

| Notes payable | $29,000 | ||

| [To record acquisition of the tractor] |

Calculations:

| Down payment | $2,000 |

| Present value of the note | $21,788 |

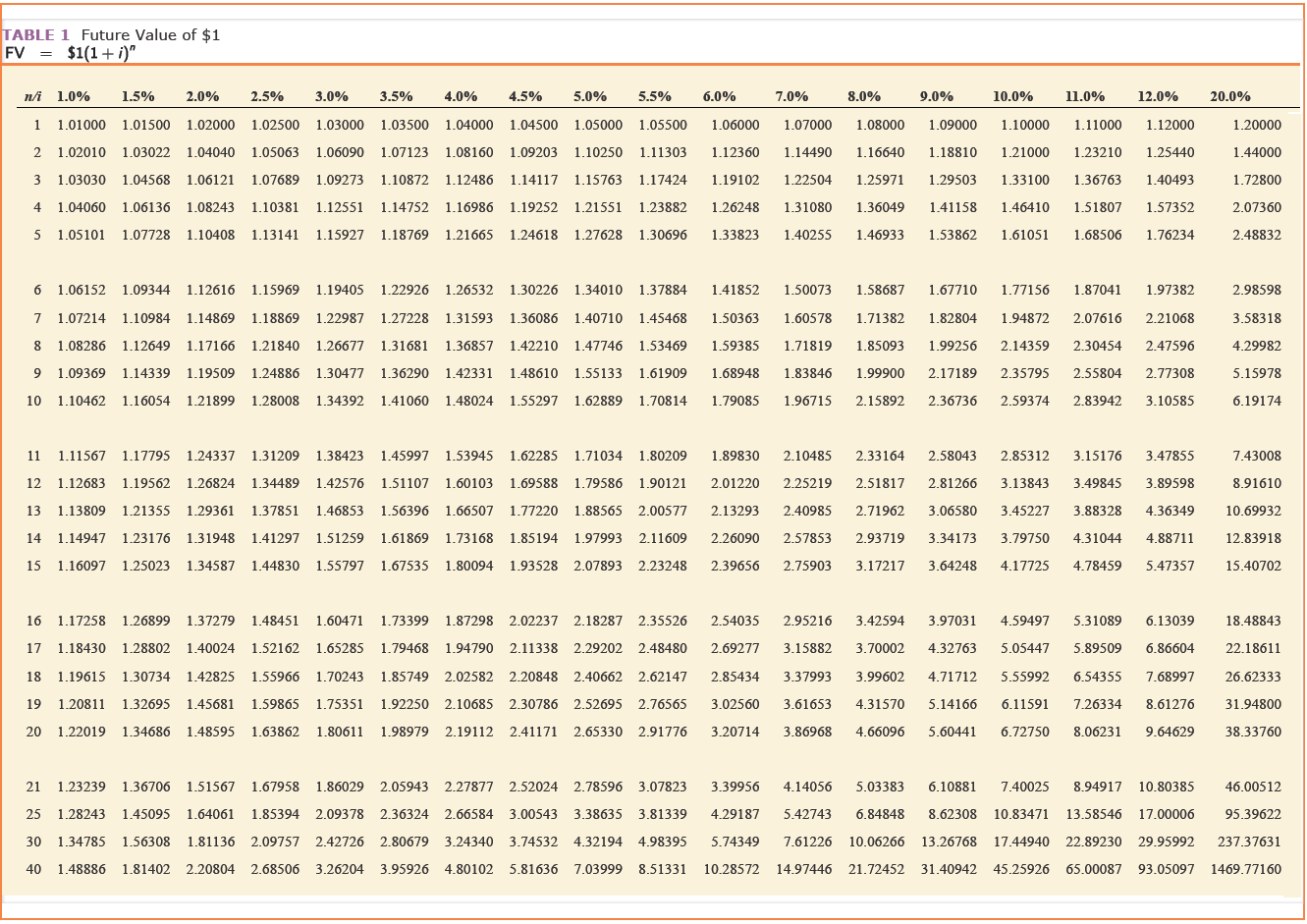

| [$29,000 x 0.75131 present value factor (10%, 3 years)] | |

| Cost of the tractor | $23,788 |

Requirement 2:

i.Interest expense for 2021 = Carrying value of the note on Jan 1,2021 x 10%

= $23,788 x 10%

= $2,178.80

ii. Interest expense for 2022 = Carrying value of the note on Jan 1,2022 x 10%

= ($23,788+$2,178.80) x 10%

=$2,396.68

Requirement 3:

Liability to be report at the end of the period,

i.For 2021 = Carrying value of the note on Jan 1,2021 + Interest expense for 2021

= $21,788 + $2,178.8

= $23,966.8

ii.For 2022 = Carrying value of the note on Jan 1,2022 + Interest expense for 2022

=$23,966.8 + $2,396.68

= $26,363.48

Add Answer to:

On January 1, 2021, Byner Company purchased a used tractor. Byner pald $2,000 down and signed...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2021, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2023. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

On January 1, 2018, Byner Company purchased a used tractor. Byner paid $4,000 down and signed...

On January 1, 2018, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $28,000 to be paid on December 31, 2020. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company’s fiscal year-end is December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of...

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000...

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2020. The fair value of the tactor is not determinable. An interest rate of 10% popery reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (EV of $1. PV of $1 FVA of $1. PVA of $1, EVAD of $1...

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2020. The fair value of the tactor is not determinable. An interest rate of 10% popery reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (EV of $1. PV of $1 FVA of $1. PVA of $1, EVAD of $1...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $150,000 (payable at maturity),...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $150,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $150,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

Blanton Plastics, a household plastic product manufacturer, borrowed $28 million cash on October 1, 2021, to...

Blanton Plastics, a household plastic product manufacturer, borrowed $28 million cash on October 1, 2021, to provide working capital for year-end production. Blanton issued a four-month, 12% promissory note to L&T Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year. Required: 1. Prepare the journal entries to record (a) the issuance of the note by Blanton Plastics and (b) L&T Bank's receivable on October 1,...

Blanton Plastics, a household plastic product manufacturer, borrowed $28 million cash on October 1, 2021, to provide working capital for year-end production. Blanton issued a four-month, 12% promissory note to L&T Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year. Required: 1. Prepare the journal entries to record (a) the issuance of the note by Blanton Plastics and (b) L&T Bank's receivable on October 1,...

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds for...

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds for $7,286,768. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Determine the effective rate of interest. 1. & 3. to 5. Prepare the necessary journal entries. Complete this question by entering your answers in the tabs below. Interest rate General Journal Determine the effective rate...

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds for $7,286,768. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Determine the effective rate of interest. 1. & 3. to 5. Prepare the necessary journal entries. Complete this question by entering your answers in the tabs below. Interest rate General Journal Determine the effective rate...

When Patey Pontoons issued 8% bonds on January 1, 2021, with a face amount of $540,000,...

When Patey Pontoons issued 8% bonds on January 1, 2021, with a face amount of $540,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 8% bonds on January 1, 2021, with a face amount of $540,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 4% bonds on January 1, 2021, with a face amount of $660,000,...

When Patey Pontoons issued 4% bonds on January 1, 2021, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 4% bonds on January 1, 2021, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $250,000 (payable at maturity),...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $250,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $250,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

On January 1, 2021, Bishop Company issued 8% bonds dated January 1, 2021, with a face...

On January 1, 2021, Bishop Company issued 8% bonds dated January 1, 2021, with a face amount of $21.0 million. The bonds mature in 2030 (10 years). For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your intermediate calculations to...

Most questions answered within 3 hours.

-

10. Net Present Value

Method and Internal Rate of Return Method for a service company

Buckeye...

asked 29 seconds from now -

An air conditioner removes hot air at 35 °C and 70 % relative

humidity from the...

asked 16 seconds ago -

TRUE OR FALSE :if false please explain

protiens folds up according to thermodynamic principles into a...

asked 2 minutes ago -

Of the 28 restaurants in an area, 4 serve on one type of

cuisine, 9 serve...

asked 17 minutes ago -

Which of the following is FALSE for catabolic pathways?

They are oxidative.

They generate oxidized enzyme...

asked 32 minutes ago -

Question 3 (20 Marks)

Read the text below and answer the question

accordingly.

ABC Enterprises Cc...

asked 39 minutes ago -

How does computer technology such as patient portals

affects revenue and expenses in a healthcare

environment?

asked 40 minutes ago -

what is the most stable chair conformation for beta -

D - Mannose

asked 41 minutes ago -

Use the definition of the fact that f(x) is O(g(x)) to

show that:

1. 7x^2 is...

asked 42 minutes ago -

In view of the fact that so many marriages end in divorce, why

do you think...

asked 57 minutes ago -

You are an entrepreneur starting a biotechnology firm. If your

research is successful, the technology can...

asked 58 minutes ago -

Operating Systems Questions (Please help if you can)

1. A computer has cache, main memory, and...

asked 1 hour ago

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2020. The fair value of the tactor is not determinable. An interest rate of 10% popery reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (EV of $1. PV of $1 FVA of $1. PVA of $1, EVAD of $1...

Check my work On January 1, 2018, Byner Company purchased a used tractor. Byner paid $2,000 down and signed a noninterest-bearing note requiring $29,000 to be paid on December 31, 2020. The fair value of the tactor is not determinable. An interest rate of 10% popery reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. (EV of $1. PV of $1 FVA of $1. PVA of $1, EVAD of $1...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $150,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $150,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

Blanton Plastics, a household plastic product manufacturer, borrowed $28 million cash on October 1, 2021, to provide working capital for year-end production. Blanton issued a four-month, 12% promissory note to L&T Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year. Required: 1. Prepare the journal entries to record (a) the issuance of the note by Blanton Plastics and (b) L&T Bank's receivable on October 1,...

Blanton Plastics, a household plastic product manufacturer, borrowed $28 million cash on October 1, 2021, to provide working capital for year-end production. Blanton issued a four-month, 12% promissory note to L&T Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year. Required: 1. Prepare the journal entries to record (a) the issuance of the note by Blanton Plastics and (b) L&T Bank's receivable on October 1,...

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds for $7,286,768. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Determine the effective rate of interest. 1. & 3. to 5. Prepare the necessary journal entries. Complete this question by entering your answers in the tabs below. Interest rate General Journal Determine the effective rate...

On January 1, 2021, Darnell Window and Pane issued $18.9 million of 10-year, zero-coupon bonds for $7,286,768. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Determine the effective rate of interest. 1. & 3. to 5. Prepare the necessary journal entries. Complete this question by entering your answers in the tabs below. Interest rate General Journal Determine the effective rate...

When Patey Pontoons issued 8% bonds on January 1, 2021, with a face amount of $540,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 8% bonds on January 1, 2021, with a face amount of $540,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 4% bonds on January 1, 2021, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

When Patey Pontoons issued 4% bonds on January 1, 2021, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $250,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...

At January 1, 2021, Brant Cargo acquired equipment by issuing a four-year, $250,000 (payable at maturity), 6% note. The market rate of interest for notes of similar risk is 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the necessary journal entries for Brant Cargo. (If no entry is required for a transaction/event, select "No journal entry...