What will be the balance on September 1, 2027 in a fund which is accumulated by...

What will be the balance on September 1, 2027 in a fund which is accumulated by making$30,000 annual deposits each September 1 beginning in 2020, with the last deposit being made on September 1, 2027? The fund pays interest at 8% compounded annually.

A.) 319,099

B.) 267,687

C.) 172,398

D.) 226,800

Homework Answers

Solution: $267,687

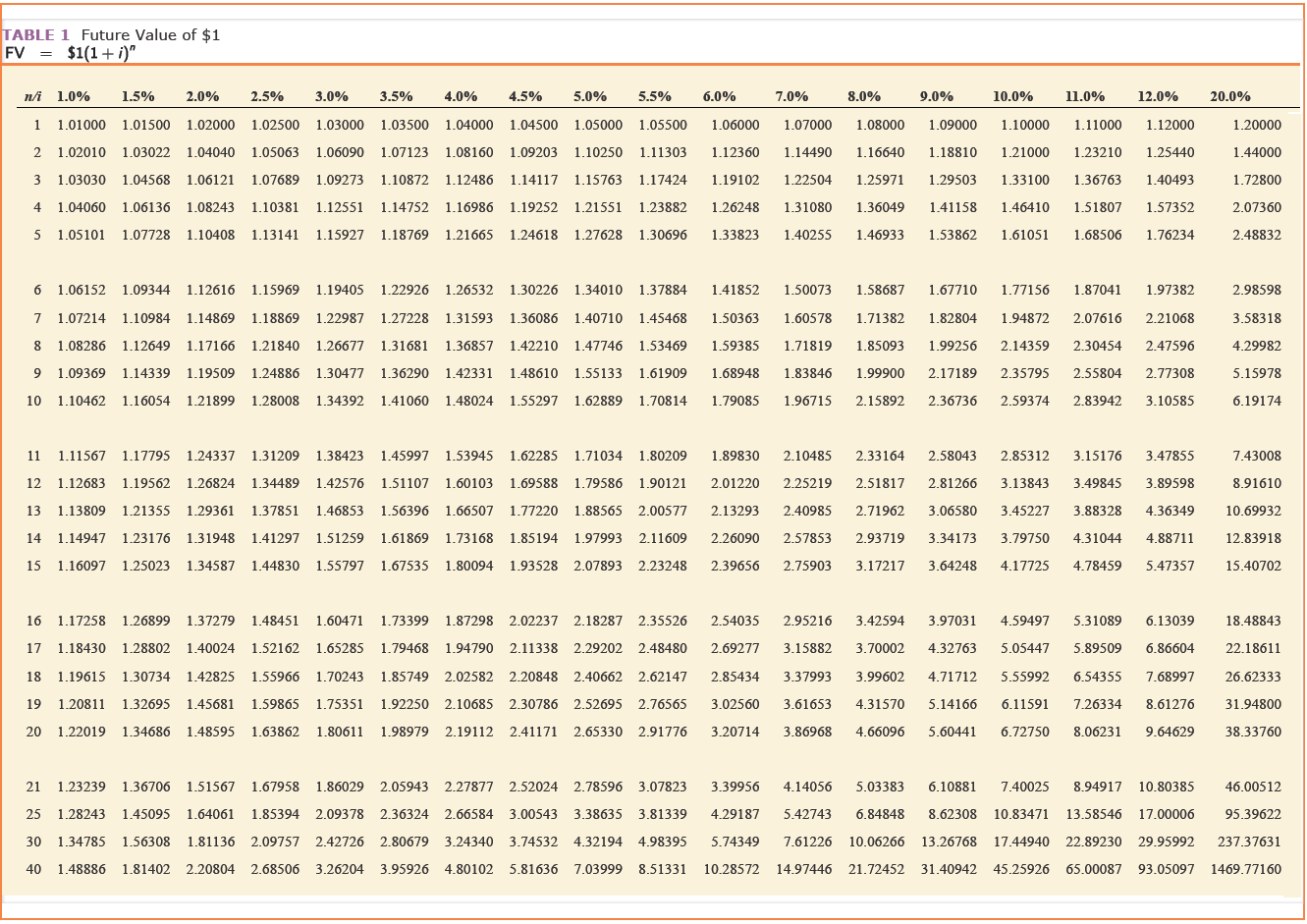

Working: Annual payments = $30,000 ; n = 7 years; i = 8%

Future value on September 1, 2027: $30,000 (F/A, 8%, 7) = $30,000 *

8.9228 = $267,687

Add Answer to:

What will be the balance on September 1, 2027 in a fund which is

accumulated by...

Wiseman Video plans to make four annual deposits of $6,500 each to a special building fund. The fund’s assets will be invested in mortgage instruments expected to pay interest at 12% on the fund’s balance. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD o

Wiseman Video plans to make four annual deposits of $6,500 each to a special building fund. The fund’s assets will be invested in mortgage instruments expected to pay interest at 12% on the fund’s balance. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Determine how much will be accumulated in the fund on December 31, 2024 after four years, under each of the...

Wiseman Video plans to make four annual deposits of $6,500 each to a special building fund. The fund’s assets will be invested in mortgage instruments expected to pay interest at 12% on the fund’s balance. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Determine how much will be accumulated in the fund on December 31, 2024 after four years, under each of the...

Wiseman Video plans to make four annual deposits of $2,250 each to a special building fund. The fund’s assets will be in...

Wiseman Video plans to make four annual deposits of $2,250 each to a special building fund. The fund’s assets will be invested in mortgage instruments expected to pay interest at 12% on the fund’s balance. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much will be accumulated in the fund on December 31, 2024, under each of the following situations....

1. Deposits are to be made to a fund each January 1 and July 1 for...

1. Deposits are to be made to a fund each January 1 and July 1 for the years 2020 through 2030. The deposit made on each July 1 will be 10.25% greater than the one made on the immediately preceding January 1. The deposit made each January 1 (except for January 1, 2020) will be the same amount as the delposit made on the immediately preceding July 1. The fund will be credited with interest at the nominal annual rate...

1. Deposits are to be made to a fund each January 1 and July 1 for the years 2020 through 2030. The deposit made on each July 1 will be 10.25% greater than the one made on the immediately preceding January 1. The deposit made each January 1 (except for January 1, 2020) will be the same amount as the delposit made on the immediately preceding July 1. The fund will be credited with interest at the nominal annual rate...

Wiseman Video plans to make four annual deposits of $2,000 each to a special building fund....

Wiseman Video plans to make four annual deposits of $2,000 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. (FV of S1, PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much will be accumulated in the fund on December 31, 2024, under each of the following situations....

Wiseman Video plans to make four annual deposits of $2,000 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. (FV of S1, PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much will be accumulated in the fund on December 31, 2024, under each of the following situations....

5. We wish to accumulate a fund of $60,000 by making regular deposits of $1,525 at...

5. We wish to accumulate a fund of $60,000 by making regular deposits of $1,525 at the end of each month for as long as is necessary. If the annual rate of interest is 6% compounded monthly, how many regular deposits will be necessary and find the final deposit to be made one month after the last regular deposit.

5. We wish to accumulate a fund of $60,000 by making regular deposits of $1,525 at the end of each month for as long as is necessary. If the annual rate of interest is 6% compounded monthly, how many regular deposits will be necessary and find the final deposit to be made one month after the last regular deposit.

A deposit of X is made into a fund which pays an rate of 12 for...

A deposit of X is made into a fund which pays an rate of 12 for 8 years. At the same time, 2X is deposited into another fund which pays a continuous compounded rate (force of interest) of o for 8 years From the end of the 4th year until the end of the 8th year, both funds the same dollar amount of interest. Calculate d (A) 7.2% (B) 7.5% |(C) 7.8% (D) 8.1% (E) 8.4% annual effective discount earn...

A deposit of X is made into a fund which pays an rate of 12 for 8 years. At the same time, 2X is deposited into another fund which pays a continuous compounded rate (force of interest) of o for 8 years From the end of the 4th year until the end of the 8th year, both funds the same dollar amount of interest. Calculate d (A) 7.2% (B) 7.5% |(C) 7.8% (D) 8.1% (E) 8.4% annual effective discount earn...

What is the Account Balance?

Victor French made deposits of $4,800 at the end of each quarter to Book Bank, which pays 8% interest compounded quarterly. After 3 years, Victor made no more deposits. What will be the balance in the account 2 years after the last deposit? (Do not round intermediate calculations. Round your answer to the nearest cent.)

1 Due Date: October 31, 2019 PGE 411 Homewok-3 3. It is desired to make an...

1 Due Date: October 31, 2019 PGE 411 Homewok-3 3. It is desired to make an initial lump sum investment that will provide for a withdrawal of $500 at the end of year 1, $600 at the end of year 2, and amounts increasing $100 per year to a final $2400 at the end of year 20. How great an initial investment will be required if it earns 12% compounded annually? 4. It is desired to invest a lump sum...

Answer each of the following independent questions. Alex Meir recently won a lottery and has the...

Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: 1598.000 cash immediately. 12 $40.000 cash Immediately and a sbe period annuity of $9.900 beginning one year from today, or asbe-period annuity of $19.800 beginning one year from today. By el $1. PV of $1. EVA of $1. PVA $1. EVAD. Si and VAD $ (Use appropriate factor(s) from the tables provided.) 1. Assuming an...

Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: 1598.000 cash immediately. 12 $40.000 cash Immediately and a sbe period annuity of $9.900 beginning one year from today, or asbe-period annuity of $19.800 beginning one year from today. By el $1. PV of $1. EVA of $1. PVA $1. EVAD. Si and VAD $ (Use appropriate factor(s) from the tables provided.) 1. Assuming an...

1. Suppose you accumulated $500,000, perhaps from many years of saving. You put the money in...

1. Suppose you accumulated $500,000, perhaps from many years of saving. You put the money in a savings plan earning 6% compounded monthly. If you want to withdraw $4,000 at the beginning of each month, how long before the savings plan is exhausted? 2. Suppose you accumulated $500,000, perhaps from many years of saving. You put the money in a savings plan earning 6% compounded monthly. If you want the plan to last 40 years, how much can you withdraw...

Most questions answered within 3 hours.

-

1. Why is the Electron Affinity of chlorine more favorable (that

is, more negative) than fluorine?...

asked 15 minutes ago -

What is the isotactic cycle kf alkene. Draw its

catalytic cylce

asked 16 minutes ago -

What is the rate constant for a reaction based on the following

experimental information?

Experiment

Rate...

asked 18 minutes ago -

1. In biology, the term "ionic bond" is used differently than in

chemistry. A biological "ionic...

asked 29 minutes ago -

write the sequence of the GFP and primer DNAs, showing each of

the primers annealed to...

asked 34 minutes ago -

19.) A zero coupon bond matures in 7 years and sells for $695.

If the tax...

asked 35 minutes ago -

In Java

#2 JAVA Write a program named salaryCalculator that accepts

input from the user that...

asked 43 minutes ago -

Why is it desirable to remove insignificant variables

from regression?

asked 39 minutes ago -

Find the electric flux through a spherical surface of

radius 5.0 mm centered on a charge of...

asked 56 minutes ago -

TB 06-108 Martock Company uses the periodic inventory ...

Martock Company uses the periodic inventory system....

asked 48 minutes ago -

If 50 J of heat are absorbed from gold necklace with mass of

0.018 kg, what...

asked 46 minutes ago -

Determine the ratio of Earth's gravitational force exerted on an

80-kg person when at Earth's surface...

asked 48 minutes ago

1. Deposits are to be made to a fund each January 1 and July 1 for the years 2020 through 2030. The deposit made on each July 1 will be 10.25% greater than the one made on the immediately preceding January 1. The deposit made each January 1 (except for January 1, 2020) will be the same amount as the delposit made on the immediately preceding July 1. The fund will be credited with interest at the nominal annual rate...

1. Deposits are to be made to a fund each January 1 and July 1 for the years 2020 through 2030. The deposit made on each July 1 will be 10.25% greater than the one made on the immediately preceding January 1. The deposit made each January 1 (except for January 1, 2020) will be the same amount as the delposit made on the immediately preceding July 1. The fund will be credited with interest at the nominal annual rate...

Wiseman Video plans to make four annual deposits of $2,000 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. (FV of S1, PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much will be accumulated in the fund on December 31, 2024, under each of the following situations....

Wiseman Video plans to make four annual deposits of $2,000 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. (FV of S1, PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Determine how much will be accumulated in the fund on December 31, 2024, under each of the following situations....

5. We wish to accumulate a fund of $60,000 by making regular deposits of $1,525 at the end of each month for as long as is necessary. If the annual rate of interest is 6% compounded monthly, how many regular deposits will be necessary and find the final deposit to be made one month after the last regular deposit.

5. We wish to accumulate a fund of $60,000 by making regular deposits of $1,525 at the end of each month for as long as is necessary. If the annual rate of interest is 6% compounded monthly, how many regular deposits will be necessary and find the final deposit to be made one month after the last regular deposit.

A deposit of X is made into a fund which pays an rate of 12 for 8 years. At the same time, 2X is deposited into another fund which pays a continuous compounded rate (force of interest) of o for 8 years From the end of the 4th year until the end of the 8th year, both funds the same dollar amount of interest. Calculate d (A) 7.2% (B) 7.5% |(C) 7.8% (D) 8.1% (E) 8.4% annual effective discount earn...

A deposit of X is made into a fund which pays an rate of 12 for 8 years. At the same time, 2X is deposited into another fund which pays a continuous compounded rate (force of interest) of o for 8 years From the end of the 4th year until the end of the 8th year, both funds the same dollar amount of interest. Calculate d (A) 7.2% (B) 7.5% |(C) 7.8% (D) 8.1% (E) 8.4% annual effective discount earn...

Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: 1598.000 cash immediately. 12 $40.000 cash Immediately and a sbe period annuity of $9.900 beginning one year from today, or asbe-period annuity of $19.800 beginning one year from today. By el $1. PV of $1. EVA of $1. PVA $1. EVAD. Si and VAD $ (Use appropriate factor(s) from the tables provided.) 1. Assuming an...

Answer each of the following independent questions. Alex Meir recently won a lottery and has the option of receiving one of the following three prizes: 1598.000 cash immediately. 12 $40.000 cash Immediately and a sbe period annuity of $9.900 beginning one year from today, or asbe-period annuity of $19.800 beginning one year from today. By el $1. PV of $1. EVA of $1. PVA $1. EVAD. Si and VAD $ (Use appropriate factor(s) from the tables provided.) 1. Assuming an...