Relatively high cost of capital is more likely to occur in which of the following: Select...

Relatively high cost of capital is more likely to occur in which of the following:

Select one:

a. Highly liquid domestic capital markets

b. None of the mentioned choices

c. Highly illiquid domestic capital markets

In principle, Multinational firms would have a higher ________ than domestic firms because their cash flows would be more diversified internationally.

Select one:

a. equity ratios

b. none of the choices

c. debt ratios

Homework Answers

Relatively high costs of capital are more likely to occur in:

C) highly illiquid domestic capital markets.

Multinational firms would have a higher debt ratios than domestic firms because their cash flows would be more diversified internationally.

Add Answer to:

Relatively high cost of capital is more likely to occur in which

of the following:

Select...

Market segmentation and asymmetric information would help explain, which of the following: Select one: a. foreign...

Market segmentation and asymmetric information would help explain, which of the following: Select one: a. foreign investors do not have capital to invest b. international investors lack skills to do research c. domestic investors lack skills to do research d. foreign investors lack information about the local markets and firms A Multinational enterprise can ________ its ________ by acquiring access to markets which are less illiquid as well as less segmented than its own. Select one: a. decrease; Marginal Cost...

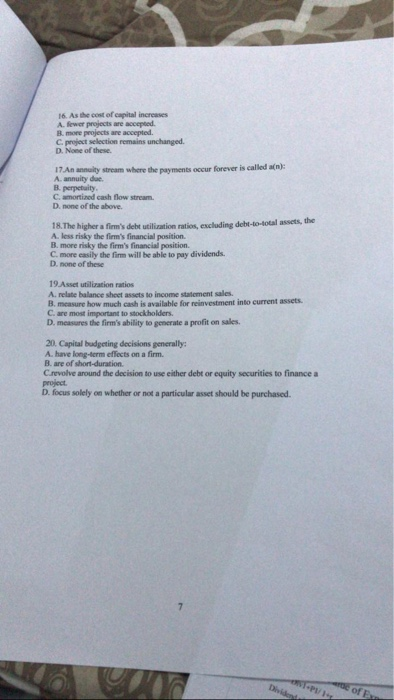

16. As the cost of capital increases A fewer projects are accepted B. more projects are...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

16. As the cost of capital increases A fewer projects are accepted B. more projects are accepted. C. project selection remains unchanged. D. None of these 17.An annulty stream where the payments occur forever is called an): A. annuity due B. perpetuity. C. amortized cash flow stream D. none of the above. 18. The higher a firm's debt utilization ratios, excluding debt-to-total assets A less risky the firm's financial position. B. more risky the firm's financial position C. more easily...

8. More on capital structure theory The Modigliani and Miller theories are based on several unrealistic...

8. More on capital structure theory The Modigliani and Miller theories are based on several unrealistic assumptions about debt financing. In reality, there are costs, taxes, and other factors associated with debt financing. These costs or effects have led to several theories that explain the impact of these factors on the capital structure of a firm. Based on your understanding of the trade-off theory, what kind of firms are likely to use more leverage? Firms with a higher proportion of...

8. More on capital structure theory The Modigliani and Miller theories are based on several unrealistic assumptions about debt financing. In reality, there are costs, taxes, and other factors associated with debt financing. These costs or effects have led to several theories that explain the impact of these factors on the capital structure of a firm. Based on your understanding of the trade-off theory, what kind of firms are likely to use more leverage? Firms with a higher proportion of...

Respondents are asked to score how frequently they use the different capital budgeting techniques on a...

Respondents are asked to score how frequently they use the different capital budgeting techniques on a scale of 0 to 4 (0 meaning "never", 4 meaning "always"). In many respects, the results differ from previous surveys, perhaps because we have a more diverse sample. An important caveat here, and throughout the survey, is that the response represents beliefs. We have no way of verifying that the beliefs coincide with actions. Most respondents select net present value and internal rate of...

Which of the following is an example of versioning? Select one: a. Charging relatively more for...

Which of the following is an example of versioning? Select one: a. Charging relatively more for razor blades than razors, b. A cable company discounts its monthly service if, customers also buy their HBO service. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features, at different prices. d. A hotel in Vegas offers a room for $50 per night, while the exact same room at other hotels would cost $105 per night....

Which of the following is an example of versioning? Select one: a. Charging relatively more for razor blades than razors, b. A cable company discounts its monthly service if, customers also buy their HBO service. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features, at different prices. d. A hotel in Vegas offers a room for $50 per night, while the exact same room at other hotels would cost $105 per night....

Which of the following is an example of price bundling? Select one: a. Charging relatively more...

Which of the following is an example of price bundling? Select one: a. Charging relatively more for razor blades than razors. b. A cable company sells the monthly service at $75/month and adds HBO for $25, even though the two normally go for $90 and $40, respectively. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features. d. A hotel in Vegas offers a room for $50 per night, while the exact same...

Which of the following is an example of price bundling? Select one: a. Charging relatively more for razor blades than razors. b. A cable company sells the monthly service at $75/month and adds HBO for $25, even though the two normally go for $90 and $40, respectively. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features. d. A hotel in Vegas offers a room for $50 per night, while the exact same...

1.Select one advantage of IRR as a capital budget method. a) It is more useful than...

1.Select one advantage of IRR as a capital budget method. a) It is more useful than NPV analysis when evaluating mutually exclusive projects. b) It accurately reflects the reinvestment rate risk. c) It is simple to understand because it ignores the time value of money. d) The IRR can easily be evaluated alongside a company's threshold rate. 2. A company invests $600,000 in a project with the following net cash flows: Year 1: $130,000 Year 2: $113,000 Year 3: $98,000...

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies...

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders Based on your understanding of the concept of cost of capital, which of the following statements are valid? Check all that apply. As the...

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders Based on your understanding of the concept of cost of capital, which of the following statements are valid? Check all that apply. As the...

Which of the following statements regarding goodwill is false? Select one: a. Goodwill is never amortized...

Which of the following statements regarding goodwill is false? Select one: a. Goodwill is never amortized for financial reporting purposes. O b. A company must review its goodwill for impairment annually O C. A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees. Od. A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than...

Which of the following statements regarding goodwill is false? Select one: a. Goodwill is never amortized for financial reporting purposes. O b. A company must review its goodwill for impairment annually O C. A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees. Od. A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than...

Which of the following statements is false in a Modigliani-Miller world? A. Capital structure does not...

Which of the following statements is false in a Modigliani-Miller world? A. Capital structure does not affect the cost of capital B. Higher leverage increase the cost of equity C. Higher leverage does not affect the WACC D. Higher leverage does not affect the cost of equity Which of the following is not an advantage of having large shareholders? A. Better coordination in monitoring management B. Executives more likely to be dismissed when underperforming C. Less shareholders' interference in the...

Most questions answered within 3 hours.

-

The cable supporting a 2145-kg elevator has a maximum strength

of 2.18×104 N.

a) What maximum...

asked 2 minutes ago -

Find the critical value(s) and rejection region(s) for a

two-tailed chi-square test with a sample size...

asked 6 minutes ago -

One of your experts gave me an answer of $7.36 but there are

many different answers...

asked 11 minutes ago -

Petrus Framing's cost formula for its supplies cost is $1,790

per month plus $10 per frame....

asked 24 minutes ago -

Introduction

Information design is a field that studies the way information

should be displayed, which is...

asked 21 minutes ago -

1.The main product of the reaction between p-cresol and Br2 /

FeBr3 is:

3-Bromo-4-methyl phenol

2-Bromo-4-methyl...

asked 26 minutes ago -

At present, concentration

of 92235U in naturally

occurring uranium deposits is approximately 0.74 %. What will the...

asked 28 minutes ago -

Question 1:

For the following reaction, 8.72 grams of nitrogen gas are

allowed to react with...

asked 31 minutes ago -

Discuss the benefits and detriments of hard water, and your

opinion on using water softeners.

asked 1 hour ago -

For a Friedel-Crafts alkylation reaction between

1,4-dimethoxybenzene with 3-methyl-2-butanol and sulfuric acid what

product was formed...

asked 47 minutes ago -

This programming assignment needs to be written so that it can

do infix expression to postfix...

asked 53 minutes ago -

Below are the reduction half reactions for chemolithoautotrophic

denitrification, where hydrogen is a source of electrons...

asked 53 minutes ago

8. More on capital structure theory The Modigliani and Miller theories are based on several unrealistic assumptions about debt financing. In reality, there are costs, taxes, and other factors associated with debt financing. These costs or effects have led to several theories that explain the impact of these factors on the capital structure of a firm. Based on your understanding of the trade-off theory, what kind of firms are likely to use more leverage? Firms with a higher proportion of...

8. More on capital structure theory The Modigliani and Miller theories are based on several unrealistic assumptions about debt financing. In reality, there are costs, taxes, and other factors associated with debt financing. These costs or effects have led to several theories that explain the impact of these factors on the capital structure of a firm. Based on your understanding of the trade-off theory, what kind of firms are likely to use more leverage? Firms with a higher proportion of...

Which of the following is an example of versioning? Select one: a. Charging relatively more for razor blades than razors, b. A cable company discounts its monthly service if, customers also buy their HBO service. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features, at different prices. d. A hotel in Vegas offers a room for $50 per night, while the exact same room at other hotels would cost $105 per night....

Which of the following is an example of versioning? Select one: a. Charging relatively more for razor blades than razors, b. A cable company discounts its monthly service if, customers also buy their HBO service. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features, at different prices. d. A hotel in Vegas offers a room for $50 per night, while the exact same room at other hotels would cost $105 per night....

Which of the following is an example of price bundling? Select one: a. Charging relatively more for razor blades than razors. b. A cable company sells the monthly service at $75/month and adds HBO for $25, even though the two normally go for $90 and $40, respectively. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features. d. A hotel in Vegas offers a room for $50 per night, while the exact same...

Which of the following is an example of price bundling? Select one: a. Charging relatively more for razor blades than razors. b. A cable company sells the monthly service at $75/month and adds HBO for $25, even though the two normally go for $90 and $40, respectively. c. In 2018, Microsoft sold four editions of Microsoft Windows, each with a different level of features. d. A hotel in Vegas offers a room for $50 per night, while the exact same...

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders Based on your understanding of the concept of cost of capital, which of the following statements are valid? Check all that apply. As the...

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders Based on your understanding of the concept of cost of capital, which of the following statements are valid? Check all that apply. As the...

Which of the following statements regarding goodwill is false? Select one: a. Goodwill is never amortized for financial reporting purposes. O b. A company must review its goodwill for impairment annually O C. A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees. Od. A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than...

Which of the following statements regarding goodwill is false? Select one: a. Goodwill is never amortized for financial reporting purposes. O b. A company must review its goodwill for impairment annually O C. A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees. Od. A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than...