(Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.)

Homework Answers

| a. | |||||||||

| Year | Year | Taxable income and pre tax cashflow | Deductible expenditure | Total cash flow | Present value factor@5% | Present value of cash flow | |||

| A | B | C | D | E=C+D | F=1/(1+5%)^A | G=E*F | |||

| 1 | 2019 | 120,000 | (500,000) | 620,000 | 0.952 | 590,476 | |||

| 2 | 2020 | 400,000 | 400,000 | 0.907 | 362,812 | ||||

| 3 | 2021 | 700,000 | 700,000 | 0.864 | 604,686 | ||||

| Net present value | 1,557,974 | ||||||||

| b. | |||||||||

| Year | Year | Taxable income and pre tax cashflow | Deductible expenditure | Total cash flow | Present value factor@5% | Present value of cash flow | |||

| A | B | C | D | E=C+D | F=1/(1+5%)^A | G=E*F | |||

| 1 | 2020 | 400,000 | (525,000) | 925,000 | 0.952 | 880,952 | |||

| 2 | 2021 | 700,000 | 700,000 | 0.907 | 634,921 | ||||

| Net present value | 1,515,873 | ||||||||

| c. | Based on the above calculation the VB should make the expenditure in the year 2019 as net present value is higher if VB invests in 2019 | ||||||||

Add Answer to:

(Round discount factors to 3 decimal places. Round

intermediate calculations and final answers to the nearest...

3 300 0.2046 5802167 57502220304 0.180 0. 11 0.0001 Di 13000.1106 0.14560125 13.300.000 O OKO 7312...

3 300 0.2046 5802167 57502220304 0.180 0. 11 0.0001 Di 13000.1106 0.14560125 13.300.000 O OKO 7312 357 0.63560 3116 07972 2008 0.7118 0 Ods, PVIF y due a the lesser after-tax cost, assuming that: a. Firm E's marginal tax rate is 20 percent. b. Firm E's marginal tax rate is 40 percent. 13. Company J must choose between two alternate business expenditures. Expenditure I would require a $80.000 cash outlay, and Expenditure 2 requires a $60,000 cash outlay. Determine the...

3 300 0.2046 5802167 57502220304 0.180 0. 11 0.0001 Di 13000.1106 0.14560125 13.300.000 O OKO 7312 357 0.63560 3116 07972 2008 0.7118 0 Ods, PVIF y due a the lesser after-tax cost, assuming that: a. Firm E's marginal tax rate is 20 percent. b. Firm E's marginal tax rate is 40 percent. 13. Company J must choose between two alternate business expenditures. Expenditure I would require a $80.000 cash outlay, and Expenditure 2 requires a $60,000 cash outlay. Determine the...

Please answer both Carry out calculations to at least 4 decimal places. Enter percentages as whole...

Please answer both

Carry out calculations to at least 4 decimal places. Enter

percentages as whole numbers. Example: 3.03% should be entered as

3.03. Do not include commas or dollar signs in numerical

answers.

Question 3 3 pts Consider a company with the following reported net income (i.e. reported sales) and accounts receivable. Compute the cash flows in each of the three years and report the NPV of these cash flows. Use a 7.5% discount rate. Assume Accounts Receivable in...

Please answer both

Carry out calculations to at least 4 decimal places. Enter

percentages as whole numbers. Example: 3.03% should be entered as

3.03. Do not include commas or dollar signs in numerical

answers.

Question 3 3 pts Consider a company with the following reported net income (i.e. reported sales) and accounts receivable. Compute the cash flows in each of the three years and report the NPV of these cash flows. Use a 7.5% discount rate. Assume Accounts Receivable in...

Year 1 2 3 4 5 6 High Demand (50%) After-tax cash flows 500,000 700,000 1,000,000 1,300,000...

Year 1 2 3 4 5 6 High Demand (50%) After-tax cash flows 500,000 700,000 1,000,000 1,300,000 1,400,000 1,000,000 Low Demand (50%) After-tax cash flows 100,000 100,000 100,000 100,000 100,000 100,000 Weighted average after-tax cash flow 300,000 400,000 550,000 700,000 750,000 550,000 . The equipment to make full-size greenhouse kits – 16 feet and 22 feet in diameter – would cost about $2.5 million. If the company closes down early the after-tax cash-flow from the sale of the equipment will...

Firm X has the opportunity to invest $288,000 in a new venture. The projected cash flows...

Firm X has the opportunity to invest $288,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Year 1 Year 2 Year 3 Year e Initial investment $(288,000) $ 57,800 (34,680) $ 57,800 (8,670) 288,800 $337,130 $57,800 (8,670) Revenues Expenses Return of investment (288,000) $ 23,120 Before-tax net cash flow $49,130 Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the...

Firm X has the opportunity to invest $288,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Year 1 Year 2 Year 3 Year e Initial investment $(288,000) $ 57,800 (34,680) $ 57,800 (8,670) 288,800 $337,130 $57,800 (8,670) Revenues Expenses Return of investment (288,000) $ 23,120 Before-tax net cash flow $49,130 Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the...

340 upany Khas a $4,000 loss before considering the additional deduction. pany P must choose between...

340 upany Khas a $4,000 loss before considering the additional deduction. pany P must choose between two alternate transactions. The cash nerated by Transaction 1 is taxable, and the cash generated by Transaction bis nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: Transaction I generates $100.000 of income and Transaction 2 generates S60,000 of income. b. Transaction i generates $160,000 of income and Transaction 2 generates $120,000 of...

340 upany Khas a $4,000 loss before considering the additional deduction. pany P must choose between two alternate transactions. The cash nerated by Transaction 1 is taxable, and the cash generated by Transaction bis nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: Transaction I generates $100.000 of income and Transaction 2 generates S60,000 of income. b. Transaction i generates $160,000 of income and Transaction 2 generates $120,000 of...

Shirt zu u zt 6 1200 . Company Khas a $4.000 loss before considering the additional...

Shirt zu u zt 6 1200 . Company Khas a $4.000 loss before considering the additional deduction 8. Company P must choose between two alternate transactions. The cash generated by Transaction 1 is taxable, and the cash generated by Transaction 2 is nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: 3. Transaction 1 generates $100,000 of income and Transaction 2 generates $60,000 of income. b. Transaction 1 generates...

Shirt zu u zt 6 1200 . Company Khas a $4.000 loss before considering the additional deduction 8. Company P must choose between two alternate transactions. The cash generated by Transaction 1 is taxable, and the cash generated by Transaction 2 is nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: 3. Transaction 1 generates $100,000 of income and Transaction 2 generates $60,000 of income. b. Transaction 1 generates...

Firm X has the opportunity to invest $254,000 in a new venture. The projected cash flows...

Firm X has the opportunity to invest $254,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Please show all calculations. Year 0 Year 1 Year 2 Year 3 Initial investment $ (254,000 ) Revenues $ 38,400 $ 38,400 $ 38,400 Expenses (23,040 ) (5,760 ) (5,760 ) Return of investment 254,000 Before-tax net cash flow (254,000 ) $ 15,360 $ 32,640 $ 286,640 Firm X uses an 8...

Firm Q is about to engage in a transaction with the following cash flows over a...

Firm Q is about to engage in a transaction with the following cash flows over a three-year period. Use Arpendix A and Appendix B. Taxable revenue Deductible expenses Nondeductible expenses Year @ $18,300 (6,700) (725) Year 1 $19,000 (8,700) (2,500) Year 2 $27,800 (9,250) If the firm's marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the NPV of the transaction. (Expenses and cash outflows should be indicated by a minus...

Firm Q is about to engage in a transaction with the following cash flows over a three-year period. Use Arpendix A and Appendix B. Taxable revenue Deductible expenses Nondeductible expenses Year @ $18,300 (6,700) (725) Year 1 $19,000 (8,700) (2,500) Year 2 $27,800 (9,250) If the firm's marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the NPV of the transaction. (Expenses and cash outflows should be indicated by a minus...

Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.)

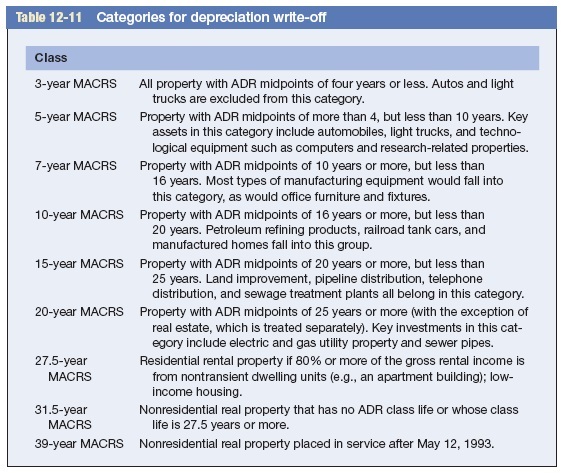

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

DataPoint Engineering is considering the purchase of a new piece of equipment for $210,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $110,000 in nondepreciable working capital. $27,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate...

U 3. Prepare an adjusted trial balance. (Do not round Intermediate calculations. Round your final answers...

U 3. Prepare an adjusted trial balance. (Do not round Intermediate calculations. Round your final answers to nearest wh 2 of 5 Answer is complete and correct. Credits OOOOOOOOO PASTINA COMPANY Adjusted Trial Balance December 31, 2021 Account Title Debits Cash 36.400 Accounts receivable 43.800 Supplies 1,010 Inventory 63.600 Notes receivable 23.600 Interest receivable 1.573 Prepaid rent 1.400 Prepaid insurance 2.400 Office equipment 94.400 Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained...

U 3. Prepare an adjusted trial balance. (Do not round Intermediate calculations. Round your final answers to nearest wh 2 of 5 Answer is complete and correct. Credits OOOOOOOOO PASTINA COMPANY Adjusted Trial Balance December 31, 2021 Account Title Debits Cash 36.400 Accounts receivable 43.800 Supplies 1,010 Inventory 63.600 Notes receivable 23.600 Interest receivable 1.573 Prepaid rent 1.400 Prepaid insurance 2.400 Office equipment 94.400 Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained...

Most questions answered within 3 hours.

-

At a certain temperature, the equilibrium constant, Kc, for this

reaction is 53.3.

H2(g)+I2(g)−⇀↽−2HI(g)Kc=53.3

At this...

asked 29 minutes ago -

Question1 ) The STL provides similiar classes called stack and

queue, both of which gave functions...

asked 1 hour ago -

For Questions 1-4, assume you have 5 bits available:

1. For (positive) integers: What is the...

asked 1 hour ago -

convert grams into vloume with the density of water being at

.997514 g/cm^3 at 23.1 Celsuis...

asked 3 hours ago -

Foreman company obtained a $20,000, 6% loan on May 1, 2018.

Principal and interest will be...

asked 3 hours ago -

5. Problem 11.05 (Discounted Payback)

eBook

Project L costs $60,000, its expected cash inflows are $14,000

per...

asked 4 hours ago -

1. Which of the following is true about politics and health

organizations?

A. Health organizations are...

asked 4 hours ago -

A space vehicle is coasting at a constant velocity of 18.1 m/s

in the +y direction...

asked 5 hours ago -

5) Use the following balanced equation to answer questions

(a)-(i).

3 Cu(s) + 8 HNO3(aq) →...

asked 5 hours ago -

A three-year maturity bond with a 12% annual coupon rate is

currently traded at par $1000...

asked 5 hours ago -

1.

What is the minimum volume to use in the Spec 20 cuvette in order

to...

asked 5 hours ago -

A builder wants to install wall-to-wall carpeting in a living

room of length 8.87 m and...

asked 5 hours ago

3 300 0.2046 5802167 57502220304 0.180 0. 11 0.0001 Di 13000.1106 0.14560125 13.300.000 O OKO 7312 357 0.63560 3116 07972 2008 0.7118 0 Ods, PVIF y due a the lesser after-tax cost, assuming that: a. Firm E's marginal tax rate is 20 percent. b. Firm E's marginal tax rate is 40 percent. 13. Company J must choose between two alternate business expenditures. Expenditure I would require a $80.000 cash outlay, and Expenditure 2 requires a $60,000 cash outlay. Determine the...

3 300 0.2046 5802167 57502220304 0.180 0. 11 0.0001 Di 13000.1106 0.14560125 13.300.000 O OKO 7312 357 0.63560 3116 07972 2008 0.7118 0 Ods, PVIF y due a the lesser after-tax cost, assuming that: a. Firm E's marginal tax rate is 20 percent. b. Firm E's marginal tax rate is 40 percent. 13. Company J must choose between two alternate business expenditures. Expenditure I would require a $80.000 cash outlay, and Expenditure 2 requires a $60,000 cash outlay. Determine the...

Please answer both

Carry out calculations to at least 4 decimal places. Enter

percentages as whole numbers. Example: 3.03% should be entered as

3.03. Do not include commas or dollar signs in numerical

answers.

Question 3 3 pts Consider a company with the following reported net income (i.e. reported sales) and accounts receivable. Compute the cash flows in each of the three years and report the NPV of these cash flows. Use a 7.5% discount rate. Assume Accounts Receivable in...

Please answer both

Carry out calculations to at least 4 decimal places. Enter

percentages as whole numbers. Example: 3.03% should be entered as

3.03. Do not include commas or dollar signs in numerical

answers.

Question 3 3 pts Consider a company with the following reported net income (i.e. reported sales) and accounts receivable. Compute the cash flows in each of the three years and report the NPV of these cash flows. Use a 7.5% discount rate. Assume Accounts Receivable in...

Firm X has the opportunity to invest $288,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Year 1 Year 2 Year 3 Year e Initial investment $(288,000) $ 57,800 (34,680) $ 57,800 (8,670) 288,800 $337,130 $57,800 (8,670) Revenues Expenses Return of investment (288,000) $ 23,120 Before-tax net cash flow $49,130 Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the...

Firm X has the opportunity to invest $288,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Year 1 Year 2 Year 3 Year e Initial investment $(288,000) $ 57,800 (34,680) $ 57,800 (8,670) 288,800 $337,130 $57,800 (8,670) Revenues Expenses Return of investment (288,000) $ 23,120 Before-tax net cash flow $49,130 Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the...

340 upany Khas a $4,000 loss before considering the additional deduction. pany P must choose between two alternate transactions. The cash nerated by Transaction 1 is taxable, and the cash generated by Transaction bis nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: Transaction I generates $100.000 of income and Transaction 2 generates S60,000 of income. b. Transaction i generates $160,000 of income and Transaction 2 generates $120,000 of...

340 upany Khas a $4,000 loss before considering the additional deduction. pany P must choose between two alternate transactions. The cash nerated by Transaction 1 is taxable, and the cash generated by Transaction bis nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: Transaction I generates $100.000 of income and Transaction 2 generates S60,000 of income. b. Transaction i generates $160,000 of income and Transaction 2 generates $120,000 of...

Shirt zu u zt 6 1200 . Company Khas a $4.000 loss before considering the additional deduction 8. Company P must choose between two alternate transactions. The cash generated by Transaction 1 is taxable, and the cash generated by Transaction 2 is nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: 3. Transaction 1 generates $100,000 of income and Transaction 2 generates $60,000 of income. b. Transaction 1 generates...

Shirt zu u zt 6 1200 . Company Khas a $4.000 loss before considering the additional deduction 8. Company P must choose between two alternate transactions. The cash generated by Transaction 1 is taxable, and the cash generated by Transaction 2 is nontaxable. Determine the marginal tax rate at which the after-tax cash flows from the two transactions are equal assuming that: 3. Transaction 1 generates $100,000 of income and Transaction 2 generates $60,000 of income. b. Transaction 1 generates...

Firm Q is about to engage in a transaction with the following cash flows over a three-year period. Use Arpendix A and Appendix B. Taxable revenue Deductible expenses Nondeductible expenses Year @ $18,300 (6,700) (725) Year 1 $19,000 (8,700) (2,500) Year 2 $27,800 (9,250) If the firm's marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the NPV of the transaction. (Expenses and cash outflows should be indicated by a minus...

Firm Q is about to engage in a transaction with the following cash flows over a three-year period. Use Arpendix A and Appendix B. Taxable revenue Deductible expenses Nondeductible expenses Year @ $18,300 (6,700) (725) Year 1 $19,000 (8,700) (2,500) Year 2 $27,800 (9,250) If the firm's marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the NPV of the transaction. (Expenses and cash outflows should be indicated by a minus...

U 3. Prepare an adjusted trial balance. (Do not round Intermediate calculations. Round your final answers to nearest wh 2 of 5 Answer is complete and correct. Credits OOOOOOOOO PASTINA COMPANY Adjusted Trial Balance December 31, 2021 Account Title Debits Cash 36.400 Accounts receivable 43.800 Supplies 1,010 Inventory 63.600 Notes receivable 23.600 Interest receivable 1.573 Prepaid rent 1.400 Prepaid insurance 2.400 Office equipment 94.400 Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained...

U 3. Prepare an adjusted trial balance. (Do not round Intermediate calculations. Round your final answers to nearest wh 2 of 5 Answer is complete and correct. Credits OOOOOOOOO PASTINA COMPANY Adjusted Trial Balance December 31, 2021 Account Title Debits Cash 36.400 Accounts receivable 43.800 Supplies 1,010 Inventory 63.600 Notes receivable 23.600 Interest receivable 1.573 Prepaid rent 1.400 Prepaid insurance 2.400 Office equipment 94.400 Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained...